TX 89th Legislature May 28, 2025

Statewide

Housing Finance Corporation (HFC) HB 21 | Signed | Effective: Immediately

STATEWIDE

Texas House Bill 21

State of Texas | Section 394.004 | 89(R) HB 21 | Signed | Effective: Immediately

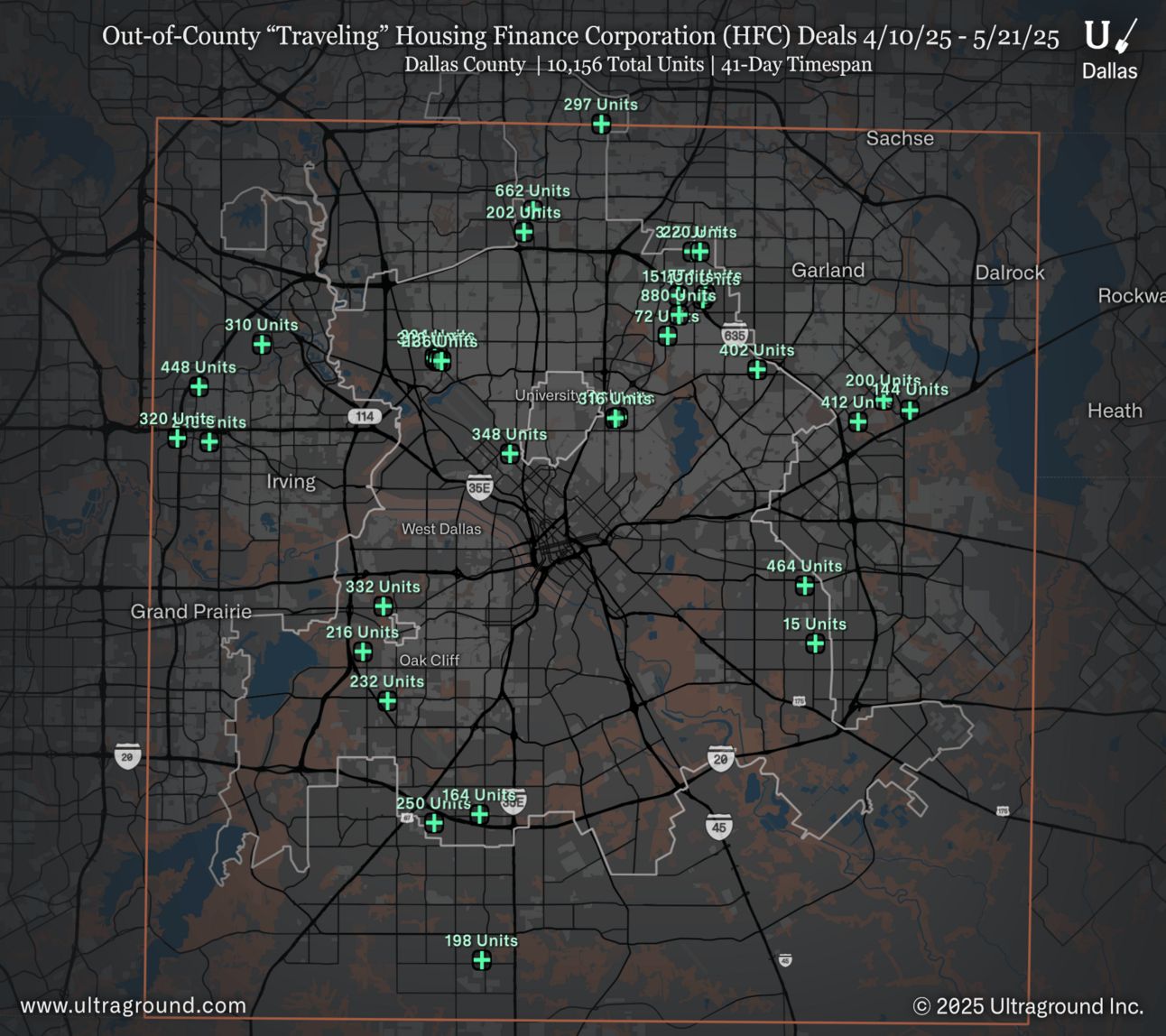

Texas House Bill 21 passed both chambers in May 2025 with strong bipartisan support (House: 113-15, Senate: 30-1) and was signed by Governor Abbott on May 28, 2025, becoming effective immediately. The bill restricts Housing Finance Corporations to operating only within their sponsoring government's boundaries, requiring approval resolutions from local municipalities and counties to develop elsewhere. HFC properties must reserve either 10% of units at 60% AMI plus 40% at 80% AMI, or 10% at 50% AMI plus 40% at 100% AMI, while providing annual rent reductions equal to at least 50% of their property tax savings. All existing HFC properties located outside their authorized jurisdictions will lose tax exemptions after January 1, 2027, unless they obtain local approval resolutions before that deadline.

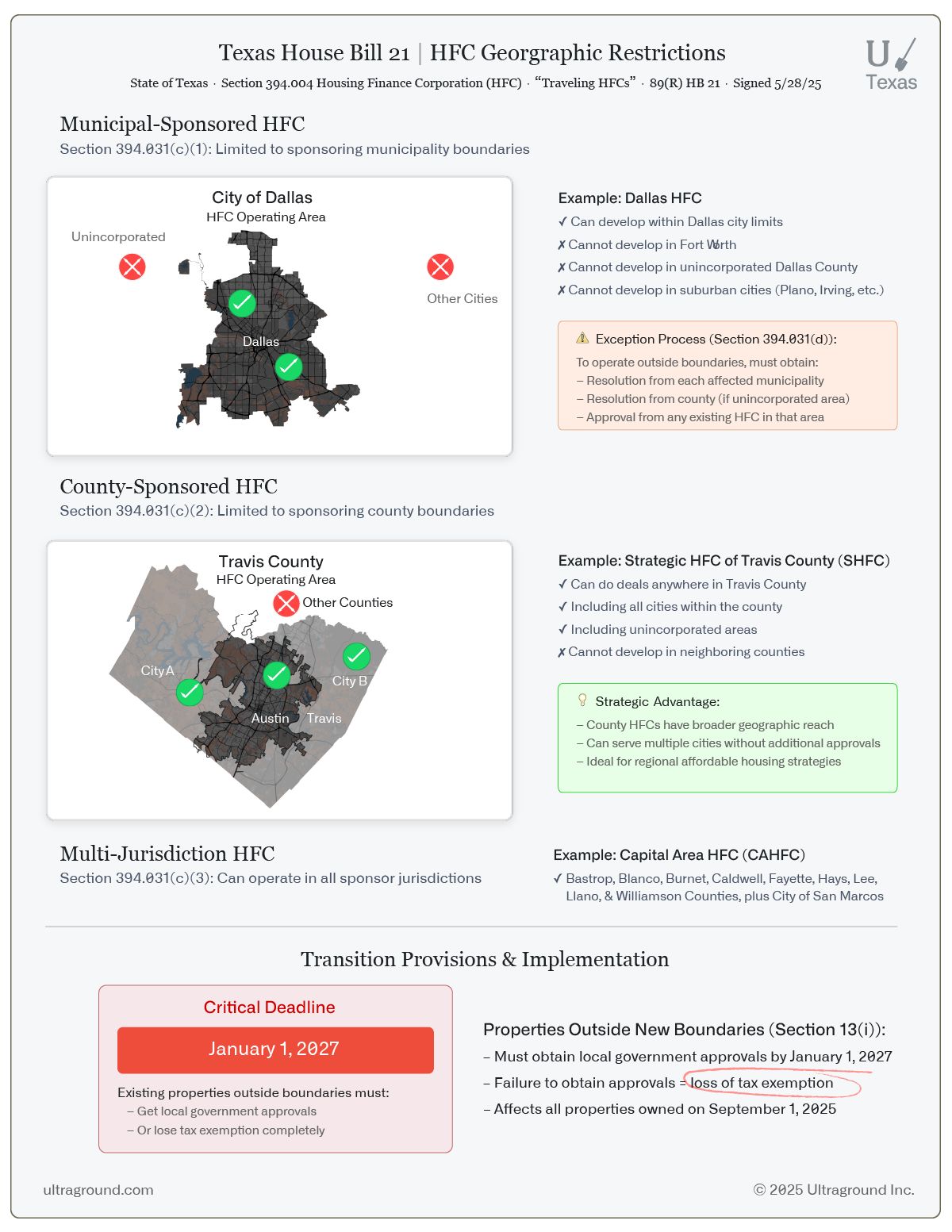

Geographic Restrictions and Operational Boundaries

The bill establishes strict territorial limitations through new Sections 394.031(c) and (d). Housing finance corporations are now confined to operating within the boundaries of their sponsoring governments. For municipal sponsors, this means development activities are limited to city boundaries. County-sponsored HFCs are restricted to county lines. Multi-jurisdictional HFCs can operate within each sponsor's boundaries but nowhere else without additional approvals.

Operations outside these designated areas require formal resolutions or orders from every affected jurisdiction. Specifically, Section 394.031(d) mandates approval from "each municipality that contains any part of the outside area" and, for unincorporated areas, "each county that contains any part of the outside area." Additionally, any HFC already operating in that jurisdiction must also approve the outside corporation's entry. This creates a multi-layered approval process that significantly complicates cross-jurisdictional development strategies.

The bond issuance authority faces similar geographic constraints under new Section 394.037(a-1). Bonds can only be issued for properties within the HFC's authorized boundaries unless the corporation secures approval resolutions from all affected municipalities and counties where the development will be located.

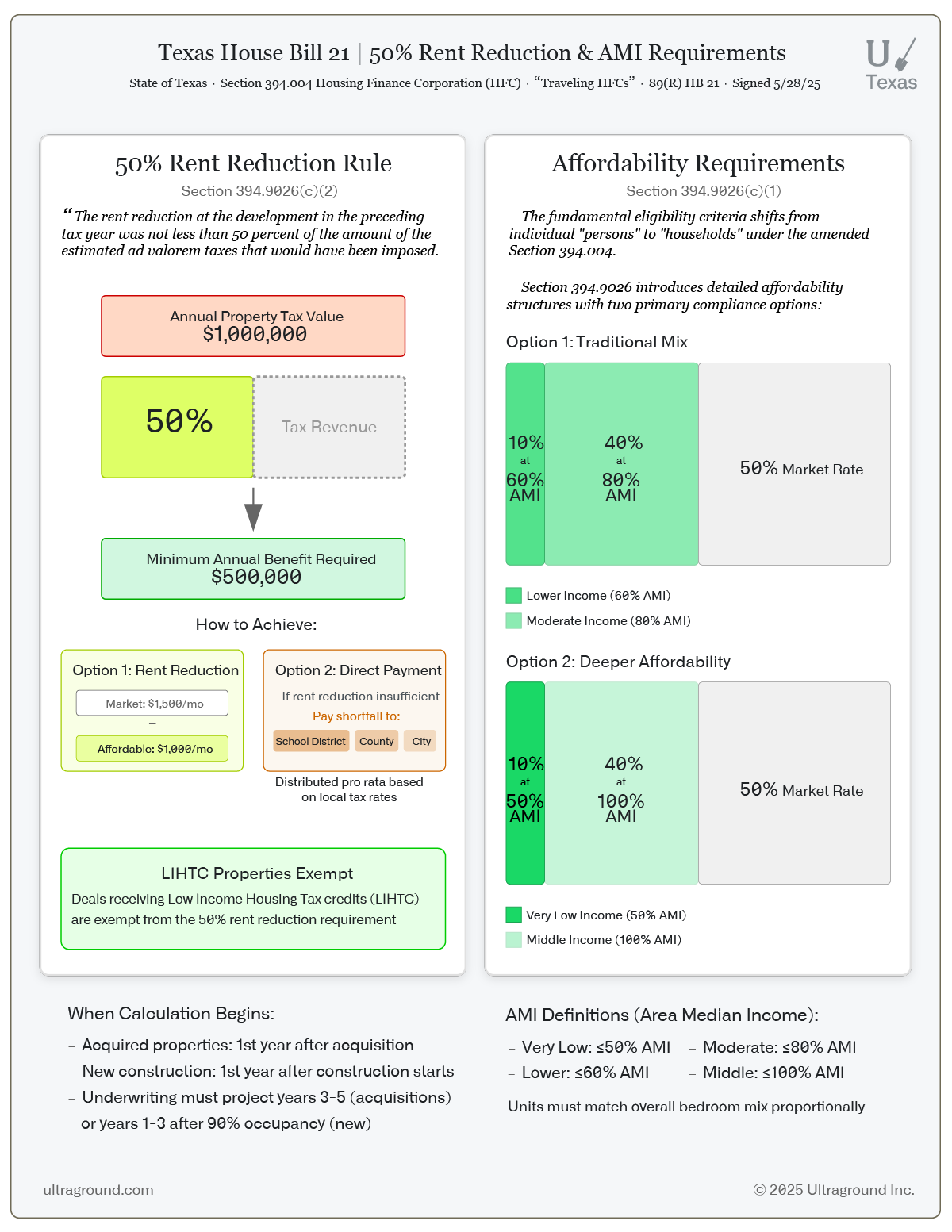

Tax Exemption Economics and Rent Reduction Requirements

The bill's most financially impactful provision appears in Section 394.9026(c)(2), requiring that "the rent reduction at the development in the preceding tax year was not less than 50 percent of the amount of the estimated ad valorem taxes that would have been imposed." This calculation begins in specific tax years: for acquired properties, "the first tax year after the tax year that the corporation acquires the development," and for new construction, "the first tax year after the tax year in which construction first begins."

If developments cannot achieve this 50% threshold through rent reductions alone, they must make direct payments to taxing units. The statute requires payment of "an amount equal to that taxing unit's pro rata share of the rent reduction shortfall that exists based on the difference between the minimum rent reduction amount" and actual rent reductions achieved.

The pre-development underwriting requirements in Section 394.905(b)(3) mandate a professional assessment demonstrating the development can meet these thresholds. The underwriting must be "dated not earlier than 180 days before the date of the board resolution" and project rent reductions for specific future tax years - the third, fourth, and fifth years after acquisition for existing properties, or the first three years after achieving 90% occupancy for new construction.

Income and Affordability Requirements

The fundamental eligibility criteria shifts from individual "persons" to "households" under the amended Section 394.004. Developments must maintain that "at least 90 percent" serves households of low and moderate income, with income determinations based on "adjusted gross income" from the preceding tax year.

Section 394.9026 introduces detailed affordability structures with two primary compliance options. The first option requires "10 percent of the units in the development are reserved for occupancy as lower income housing units and at least 40 percent of the units in the development are reserved for occupancy as moderate income housing units." The alternative structure mandates "10 percent of the units in the development are reserved for occupancy as very low income housing units and at least 40 percent of the units in the development are reserved for occupancy as middle income housing units."

These income categories are precisely defined:

Very low income: not more than 50% of area median income (AMI)

Lower income: not more than 60% of AMI

Moderate income: not more than 80% of AMI

Middle income: not more than 100% of AMI

Monthly rent restrictions follow the 30% of income standard for each category. For instance, moderate income units cannot exceed "30 percent of 80 percent of the area median income, adjusted for family size."

LIHTC Property Exemptions

Properties receiving Low Income Housing Tax Credits under Subchapter DD, Chapter 2306 are exempt from several requirements including the rent reduction calculations, pre-development underwriting, and certain audit provisions during the period they receive credits.

Housing Choice Voucher Requirements

Section 394.9026(c)(6) prohibits discrimination against Housing Choice Voucher participants. Developments cannot "refuse to rent a residential unit in the development to an individual or family because the individual or family participates in the housing choice voucher program." Income screening is specifically limited - voucher participants cannot be required to have "a monthly income of more than 250 percent of the individual's or family's share of the total monthly rent."

Beyond non-discrimination, Section 394.9026(c)(8) requires affirmative efforts including marketing "available residential units directly to individuals and families participating in the housing choice voucher program" and notifying "local housing authorities of the development's acceptance of tenants in the housing choice voucher program."

Compliance Audit Requirements

Section 394.9027 establishes a comprehensive audit regime. Annual compliance audits must be "prepared at the expense of the housing finance corporation user and conducted by an independent auditor or compliance expert with an established history of providing similar audits on housing compliance matters." These audits verify compliance with all Section 394.9026 requirements and calculate "the difference in the rent charged for income-restricted residential units and the estimated maximum market rents."

Initial audit reports are due by June 1 following acquisition for existing properties or first occupancy for new construction, with subsequent reports due each June 1 thereafter. Notably, Section 394.9027(h) requires auditor rotation: "An independent auditor or compliance expert may not prepare an audit under Subsection (b) for more than three consecutive tax years for the same housing finance corporation."

TDHCA reviews these audits within 60 days and publishes findings on its website. Non-compliance triggers a detailed notification process with 120-day initial notice and 180-day cure periods. The department must provide "at least one option for a corrective action to resolve the noncompliance."

Unit Quality and Distribution Requirements

Section 394.9026(c)(3) mandates that "income-restricted residential units in the development have the same unit finishes and equipment and access to community amenities and programs as residential units that are not income-restricted." This prevents any differentiation in unit quality based on affordability level.

The distribution requirement in Section 394.9026(c)(4) ensures proportional allocation across unit types. The "percentage of very low, lower, moderate, and middle income housing units reserved in each category" based on bedroom count must match "the percentage of each category of income-restricted residential units reserved in the development as a whole."

Tenant Protection Provisions

Section 394.9026(c)(9) establishes substantial tenant protections that cannot be waived. Landlords "may not retaliate against the tenant or the tenant's guests by taking an action because the tenant established, attempted to establish, or participated in a tenant organization."

Lease non-renewals are restricted to specific causes: "substantial violations of the lease," failure to provide required income information, or "repeated minor violations of the lease that disrupt the livability of the property." The landlord must provide "written notice of proposed nonrenewal on the tenant not later than the 30th day before the effective date of nonrenewal."

Transition Provisions and Implementation Timeline

Section 13 creates different compliance timelines based on acquisition dates. Properties acquired before the effective date must comply with voucher acceptance and tenant protection requirements by January 1, 2026. Full affordability compliance has a longer timeline - the earlier of 10 years or upon refinancing, title conveyance, or majority ownership change.

Critically, Section 13(i) addresses existing properties outside newly authorized boundaries: "A residential development that is owned by a housing finance corporation on September 1, 2025, and is located outside an area in which the corporation is authorized to own real property...is not eligible for an ad valorem tax exemption...after January 1, 2027," unless proper approvals are obtained.

Exemptions for Specific Tax Districts

Section 394.905(d) creates carve-outs for certain special districts. Conservation and reclamation districts providing water, sewer, or drainage services retain taxing authority unless the HFC enters "a written agreement with the district to make a payment to the district in lieu of taxation." Emergency services districts receive identical treatment.

This legislation represents a fundamental shift in how housing finance corporations operate in Texas, introducing geographic constraints, economic thresholds, and compliance requirements that will significantly affect development feasibility and ongoing operations across the state's affordable housing sector.

HB 21: House Bill 21 Enrolled

Visualized HB 21: Geographic Restrictions, AMI Reqs, 5050 Rent Reductions

Thank you for being a part of Ultraground.

Consider joining on of our higher tiers to access in-depth data-driven reports on specific deals. New members also receive our robust 200-deal dataset on traveling HFCs, including developer/investor contacts, locations, and terms.

Contact us to learn more:

Phone: (512) 655-9309

Email: [email protected]